Diary of a Football Trader – Issue 35

Get Pro Trader's “TRADE OF THE DAY” right here

This is your opportunity to follow a Real Pro Trader – LIVE

Since August 2020, Pro Trader has been sharing his trading analysis and results on our blog.

He has consistently made 3 and 4 figure profits EVERY WEEK

Now he is going to share his TOP TRADE every day

– All his pre match analysis

– How and Why he selected the match

– The exact markets to trade

– When to ENTER and when to EXIT

….AND.. what to do when things go positively and when things don't go to plan

ProTrader started his career and fascination with the financial markets as an Index Analyst at FTSE. He has since consulted for 15 years for some of the top Financial Institutions and Investment Banks in the world, where he specialized in financial instruments, pricing data, trading platforms and risk management solutions. He first started trading sports markets in early 2000, after the introduction and discovery of Betfair. He now trades the financial markets whilst working on entrepreneurial ventures with a focus on sports trading apps and e-commerce. He lives with his wife and young daughter and enjoy travelling (when permitted). In his spare time, he is writing a series of books, enjoys outdoor pursuits with his family, and of course, trading football markets.

Diary of a Football Trader – Issue 35

In the past few issues, we’ve looked at match analysis tools (used to discover and determine trading opportunities), and then trade management, covering both positive and negative scenarios in a match trading context. Now, these particular aspects (although there are many others), can take a considerable amount of time, concentration and discipline. In other words, it is an investment of both your time and money in order to generate a profit, or a decent long-running return on your investment.

So how does Football Trading stack up against other investment opportunities? To find out, we shall compare three other liquid investments that you could buy today. Those being:

– Managed Funds

– Commodities (gold in this instance)

– Cryptocurrency (Bitcoin)

I was going to include property (UK), but this isn’t a liquid investment, and other high costs and fees would also need to be factored in, notwithstanding the large initial investment or borrowing costs. But at the moment, this market in terms of price increase has been fairly flat the last quarter (regional dependent). But as a landlord, you could expect to make between 2-8% return, per year on average.

For the purpose of this exercise, a look at various investments in the last three months (a quarter) is used as the most recent check-point (21st January – 21 April 2021). Sure, this is a short-term view, but isn’t the long-term just the accumulation of the short-term?

Professionally Managed Funds

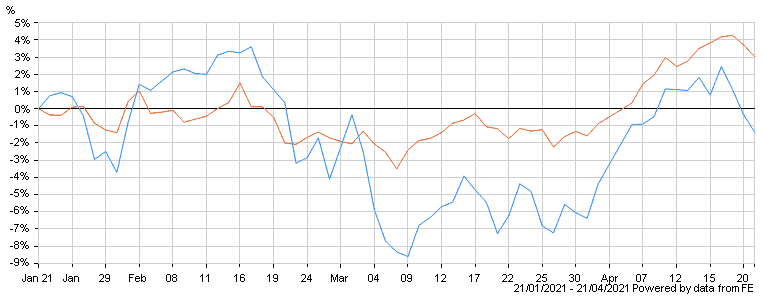

I have investments in various funds, over ten in fact. Two of the best performers in my portfolio are the AXA Framlington Global Technology and the LF Lindsell Train UK Equity funds. It should be noted that these two funds are different in their outlook and the companies they invest in. The names should give it away, but the first is global and only involved in tech stocks, whereas the latter is purely UK based across a range of industries.

The former has produced a 77% return since it was bought in March 2019, whilst the latter has produced 99% return since May 2014. Both decent returns. However, in the last three-month period, the former has produced a 1.5% loss, and the latter a 3% gain (AXA Global Tech in blue, LF UK Equity in red).

Source: Hargreaves Lansdown

Whether the poor recent performance of these funds is purely Covid-19 related remains to be seen, but it is clear that many managed funds have been affected by this. Hopefully, with the global vaccination roll-out things will begin to pick-up again later this year or next.

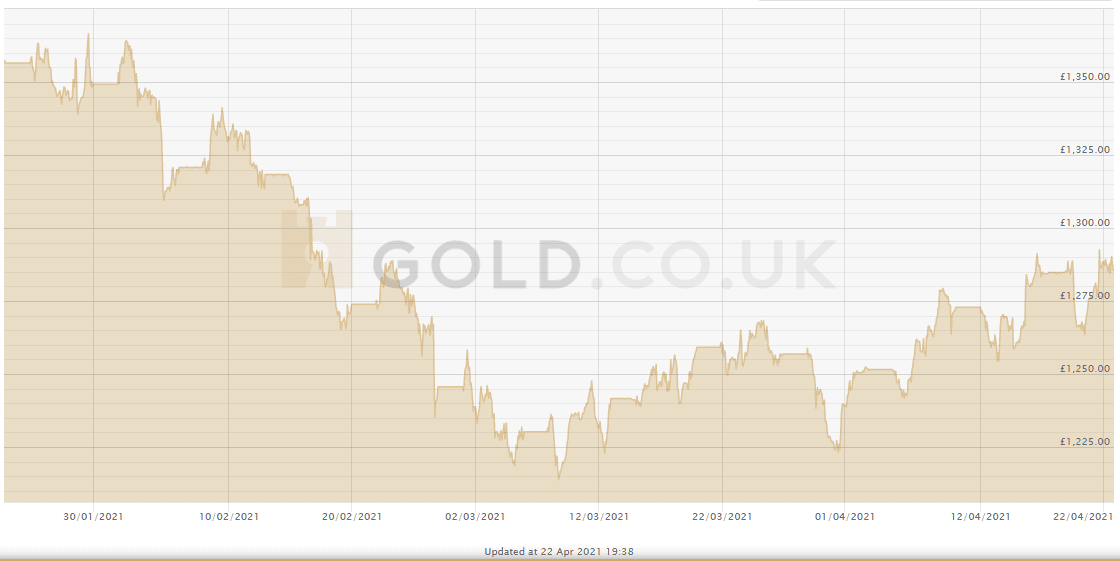

Commodities – GOLD

One of the most popular commodities to invest in, especially in times of uncertainty is gold. It is seen as a safe-haven to protect against other economic factors that are occurring in other markets (such as prices in equities, bonds, interest rates etc.). The below chart shows the price of gold (per ounce) over the last three-month period. As you can see, from the end of January the price has fallen fairly substantially before picking up from the beginning of April. Overall this investment during the last three-month period would have resulted in over a 5% loss.

Source: Gold.co.uk

Personally, I do not hold any gold. I have occasionally traded the price on an exchange, but it’s a commodity that I’m really not that interested in, and overtime I think the price will fall further as investors move more in to cryptocurrencies.

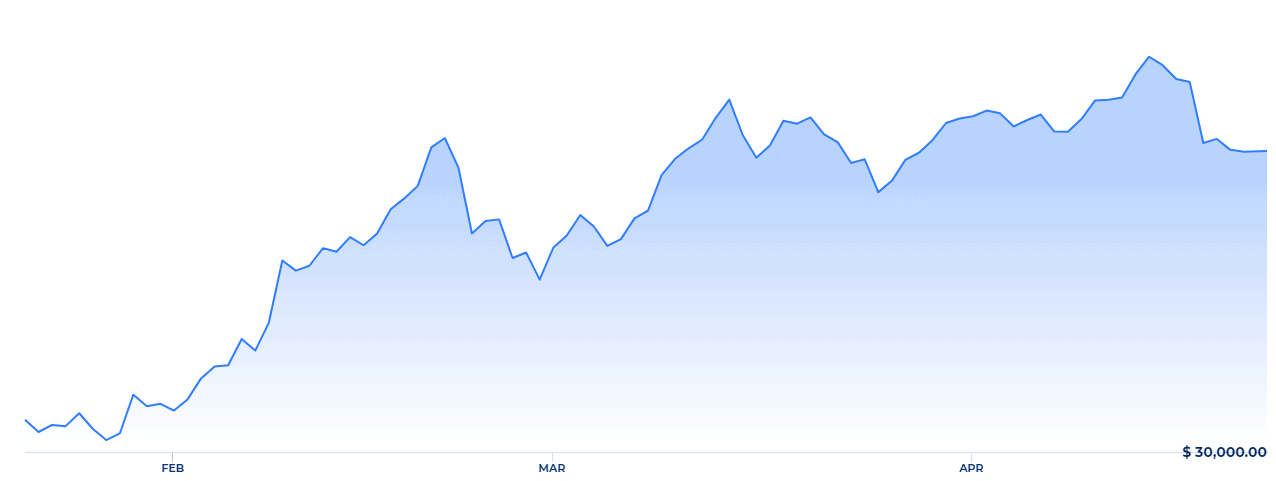

Cryptocurrency – BITCOIN (BTC)

Cryptocurrencies are becoming more popular as a form of investment, even though their trading price is hugely volatile. Massive increases one day, followed by big drops the next. Why the volatility and dramatic price escalations and corrections? It’s a variety of factors that aren’t relevant or possible for the purpose of this investment comparison summary. However, there are presently 221 different cryptos that can be invested in. The biggest and most well-known is Bitcoin (BTC), with a market capitalization of $1.05 trillion. So again, let’s look how BTC fared over the last 3 months.

The chart below shows the BTC price over this period, which has risen quite dramatically, resulting in over a 70% gain. An impressive return for investors.

Source: Coinranking.com

Personally, I do hold Bitcoin, but it’s not something I actively trade due to the extreme volatility. I’m happy to hold and wait. I see it as a long-term investment, not a regular monthly income.

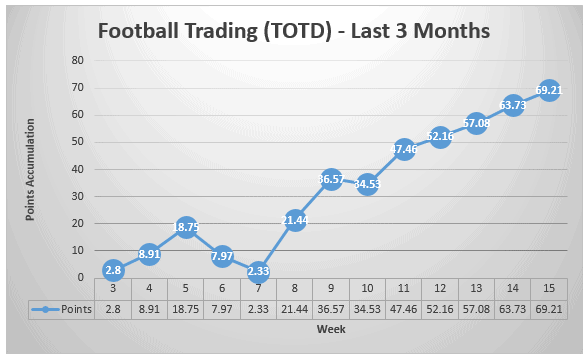

Football Trading

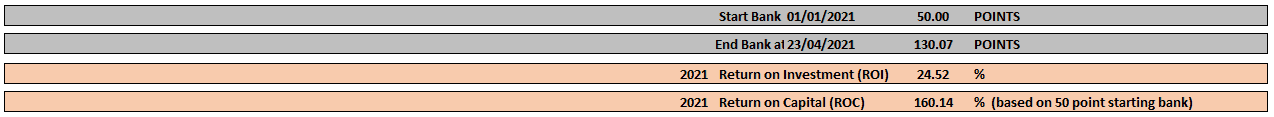

This will be taken from the ‘Trade of The Day’ service launched by Football Advisor last year, which I am proud to be a part of. It’s based on just a single trade a day on a football match, although there were nine ‘no trade days’ due to the International break during this period. As this was recorded from 21st January to fall in-line with the other investments, the first week (3) is based on just a single trade. It should also be noted that the points are only those accumulated, and does not include the 50 point bank starting capital.

Overall during this three-month period, the return is over 113%. Of course there are dips and pull-backs, like any investment. There is no investment in the world that progresses on a straight linear line – not one. It’s not possible, otherwise everyone would invest in this miracle.

As of today, from the beginning of the year, the Football Trading return is over 160%.

Don’t think for a minute this is an advert for you to join Trade Of The Day. As I said in a previous issue, I would much rather you learned to fish than throw you a fish once a day. Although, if ‘Trade of The Day’ can help to develop these skills and get you on the right path, where recommendations and selections are described in detail, then I’d be happy to assist this learning and development, even for just a month or two.

The conclusion of this analysis is that it’s possible for Football Trading to outperform even what is thought as some of the best investments in the World, whilst also demonstrating limited risk. If the same clear formula and structure is applied to each trade, it can more than out-perform other investment opportunities available, whilst managing risk and negating volatility (such as from cryptos).

The table below shows the summary of this analysis on these investments:

| INVESTMENT TYPE | 3M RETURN (%) |

| Managed Funds | 1.5 |

| Gold | -5 |

| Crypto (BTC) | 71 |

| Football Trading | 113 |

Trading Football Markets is something that you can manage yourself, with whatever start-up capital you have available. You set the goals, you set the limits, you set the trades. You can do this from anywhere. Pure self-managed investment and income decisions. What’s not to like? So what’s stopping you starting today.

And if you are an active football trader already, and anyone questions your decisions, suggest you are gambling, or just doesn’t understand what you are trying to achieve, then you can show them this table, the graphs and the pure facts. It’s safer and provides a better return than managed funds, gold or Bitcoin when approached and managed in the correct way.

We can repeat this exercise in another three months, and we can re-visit how the different investment types compare again. Please leave comments if you’d like to see other investment opportunities compared in this analysis.

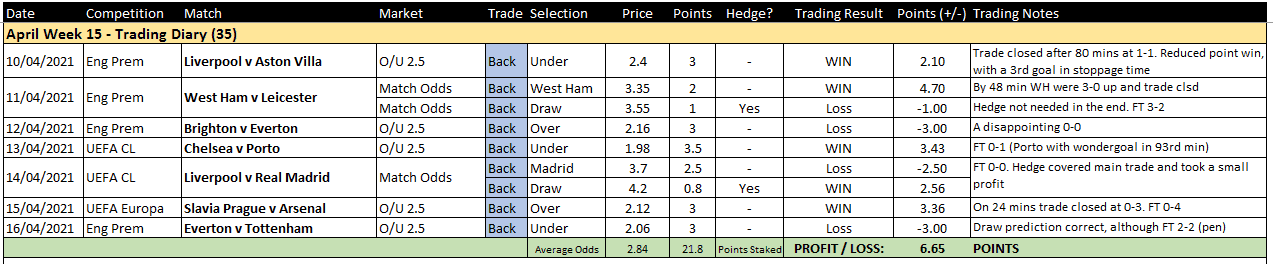

Moving on, let’s now look at the analysis, matches and trades taken in the markets in the last week of Football Trading.

Saturday, 10th April, 2021

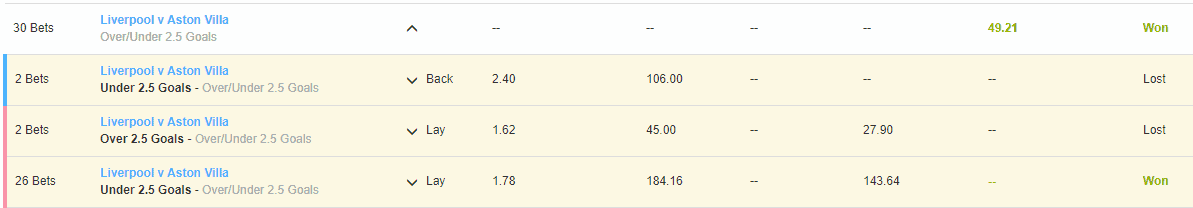

Liverpool v Aston Villa

Liverpool go in to this match as favourites, currently priced at 1.54, Aston Villa at 6.8, with the draw at 4.7.

Considering that Liverpool have seen under 2.5 goals in 4 of their last 5 home matches (the exception coming against Man City), and that Aston Villa have seen the same numbers in their away matches, under 2.5 goals here looks highly likely.

Also it should be noted that Liverpool have the 2nd-leg of their Champions League tie with Real Madrid on Wednesday, and key strikers could well be rested here (Salah / Mane).

Another important factor, is that Aston Villa have the 3rd tightest defence in the Premier League so far, conceding just 31 goals (Chelsea are 2nd on 30).

When the above information and stats are considered, then the price of under 2.5 goals at 2.4 looks a high-value trade position. The price is also expected to drop fairly quickly here after kick-off, and so a decent profit would be available before half-time.

Under 2.5 Goals

I took a back position on under 2.5 before the start for £106 at 2.4. As the match progressed goalless, I increased the exposure slightly by laying over 2.5 at 1.62. Aston Villa scored late in the first-half, and so I began to come out of the position, incrementally. By mid-way through the second-half I was fully out of the trade to bank a £49 profit. Liverpool actually scored in stoppage time, which is why this trade is recorded as a reduced point win. But as a rule, always close a trade before the final whistle to make sure that late last minute goals don’t take your available profit away from you.

Sunday, 11th April, 2021

West Ham United v Leicester City

Leicester go in to this match as favourites, currently priced at 2.36, West Ham at 3.35, with the draw at 3.55.

West Ham go in to this match without Michail Antonio, their second-highest goal-scorer (midfielder Tomas Soucek is top, with 9). However, Leicester are without their top goal-scorer from open-play, Harvey Barnes (9 goals). Yes, Jamie Vardy is on 12 goals but 6 of those are from penalties. This actually puts Vardy on the same number of open-play goals as Jesse Lingard, who only joined West Ham at the end of January this year.

Looking at markets for a trade recommendation, BTTS – ‘Yes' appeals, although the price is just 1.76. Over 2.5 goals also appeals and is priced at 1.98 (down from a high of 2.14).

However, the value here looks to be backing West Ham at 3.35.

Match Odds – West Ham United

Before kick-off, I took a back price on ‘West Ham’ at 3.35 for £50. With West Ham up 2-0 in the first-half, I began coming out of the trade to reduce any risk of a resurgent Leicester. This reduced profit, but still banked a £69 profit.

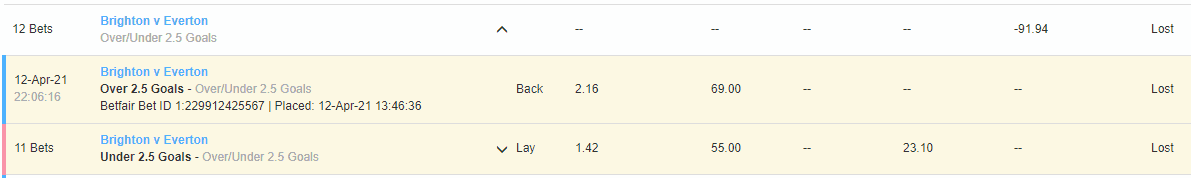

Monday, 12th April, 2021

Brighton v Everton

Brighton go in to this match as favourites, currently priced at 2.42, Everton at 3.35, with the draw at 3.4.

Both teams are currently under-achieving in terms of their potential. Brighton appeared to be turning a corner recently with back-to-back wins over Newcastle and Southampton, before losing their last match away to Manchester United. However, they did take the lead in this fixture, before conceding 2 goals in the second-half.

Everton's form has been poor of late, including drawing with Crystal Palace and losing to Burnley, both at home. These are matches Everton would have been expected to win, given that both these sides are well in the bottom half of the table.

Bottom line is, I don't have enough confidence in either of them to back outright, and so other markets are looked at.

BTTS – ‘Yes' appeals at a decent price of 1.9. Over 2.5 goals also appeals and is priced at 2.16 (down from a high of 2.32).

Given that 3 of the last 5 meetings between these sides have produced over 3.5 goals, with the last match registering over 5.5 goals, the value here looks to be backing over 2.5 at a decent price.

It should also be noted, that all Premier League matches played over the weekend just gone produced over 2.5 goals, with both teams scoring in all but 1 of them.

Over 2.5 Goals

Before kick-off I took a back position on over 2.5 for £69 at 2.16. Later, as the match progressed goalless, I increased this position by laying under 2.5 at 1.42. However, with both teams incapable of scoring, this went on to finish 0-0 and a £91 loss resulted.

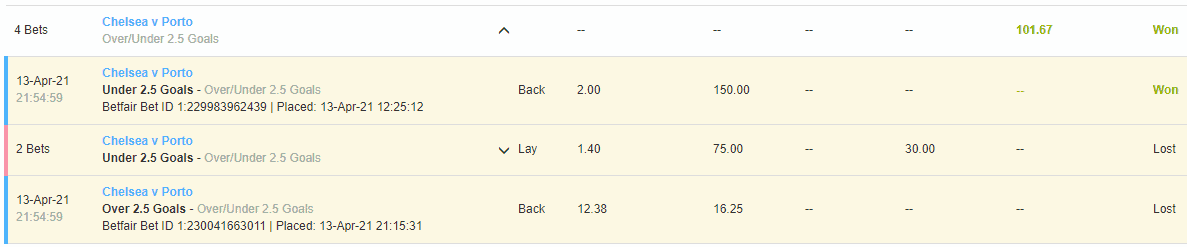

Tuesday, 13th April, 2021

Chelsea v Porto

Chelsea go in to this match as favourites, currently priced at 1.91, Porto at 4.5, with the draw at 3.85.

The back price on Chelsea looks appealing at initial appraisal here. However, starting with a two-goal lead, Chelsea manager Thomas Tuchel has no reason to take any risk and chance his defence being exploited from the Porto counter-attack. This inevitably will lead to long spells of harmless, defensive possession for Chelsea, to run down the clock without establishing clear chances, but securing their place in the semi-finals.

This then points to a tight, cagey match that could quite realistically end 0-0, which would see a trade backing Chelsea come unstuck.

Instead, the under 2.5 goals market is favoured at a decent price of 1.98.

Under 2.5 Goals

Before kick-off I took a back position on under at 2 for £150. As the match wore on goalless, I began to reduce risk by laying under at 1.4. In the end, there was in fact as late goal by Porto, resulting in 0-1 and £102 profit.

Wednesday, 14th April, 2021

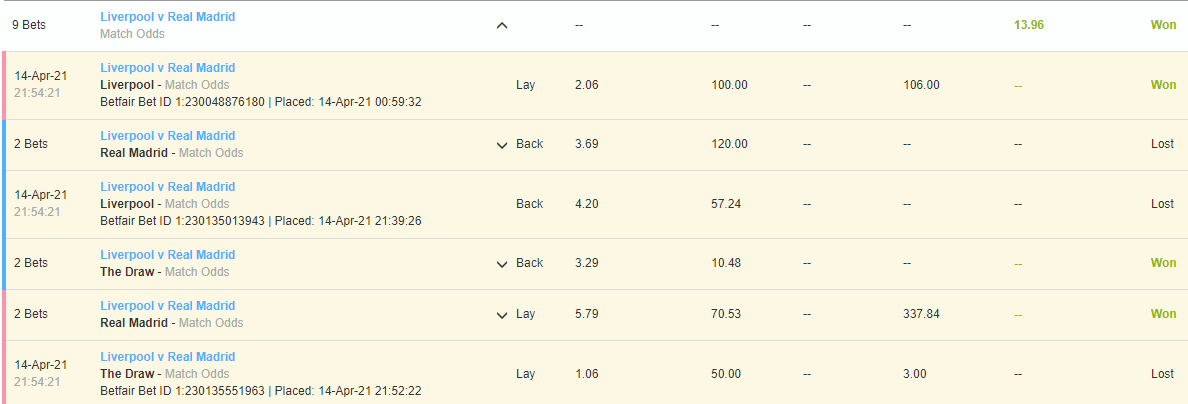

Liverpool v Real Madrid (CL Quarter Final, 2nd Leg)

Liverpool go in to this match as favourites, currently priced at 2.02, Real Madrid at 3.7, with the draw at 4.2.

Yesterday we saw Chelsea play out a 0-0 (until the 93rd minute) with a defensive display, having just 1 shot on target. It was predicted that the match would play out this way in the trade recommendation (under 2.5 goals). The PSG v Bayern match witnessed the same scenario, with Bayern winning 0-1, but with PSG going through to the semi-finals.

Will Real Madrid play the same strategy, sit deep, defend their lead and not look to score? The answer is, not likely. Zidane's team are on a roll at the moment, having won their last 6 matches, including last weekend's ‘El Classico' against Barcelona (2-1). Real Madrid have failed to score in a match just 3 times this season (from 30 matches). Liverpool have failed to score 8 times (31 matches).

Real Madrid have the ability to absorb the Liverpool pressure, before punishing them on the counter-attack with Benzema and Vinicius Jr, against a weakened Liverpool defence.

Therefore, the value here is to back Real Madrid at a high-value price of 3.7, with a small hedge on the draw to cover. This has the same effect as laying Liverpool, but with greater weighting to Real Madrid than the draw.

Match Odds

Backing ‘Real Madrid' offers decent value for this match from a trading perspective at 3.7. The smaller staked hedge on the draw would cover any loss if Real Madrid don't win as expected.

I took a back position on Real Madrid for £120 at 3.69, whilst also backing the draw to cover this. In the end, the match ended 0-0, and so the recommended hedge trade produced a £14 profit.

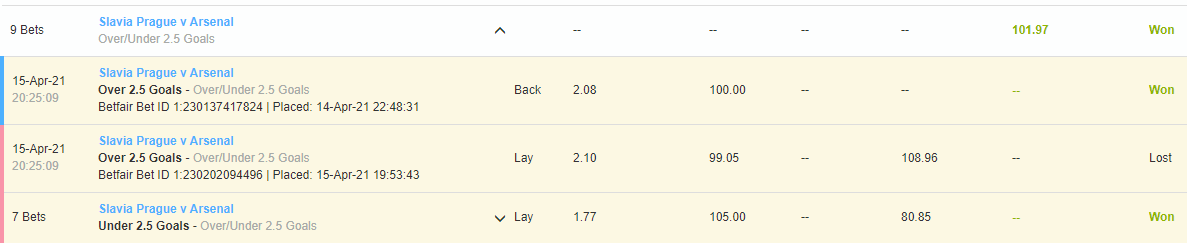

Thursday, 15th April, 2021

Slavia Prague v Arsenal (UEFA Europa League)

Arsenal go in to this match as favourites, currently priced at 1.86, whereas Slavia Prague are 4.8, with the draw 3.9.

Initial analysis makes the back price on a straight Arsenal win quite appealing. Looking at xG for this match, Slavia Prague are on 1.08 with Arsenal on 1.49. In the previous leg, Slavia Prague created 0.73, with Arsenal 2.27. This highlights how fortunate Slavia Prague are to be going in to this match on level terms (or unfortunate for Arsenal).

In 4 of Arsenal’s last 5 away matches, they have scored 3 goals per match, against Leicester City, Olympiakos, West Ham and last weekend against Sheffield United. However, in all but 1 of these matches they have also conceded.

Other markets of interest are BTTS ‘Yes’ at 2, and over 2.5 goals at 2.12. However, with the tie evenly poised (although Prague have slight advantage with the away goal), over 2.5 goals looks to be the best value trade. It shouldn't be such a cagey match, where a team looks to sit on a lead from the previous leg. Both teams should look to go out and attack, thus creating chances and goals – especially with Arsenal's recent away goal exploits.

Over 2.5 Goals

Backing ‘Over' offers decent value for this match from a trading perspective at 2.12. Before kick-off I took a back position on over at 2.08 for £100. I came out of the trade slightly after the first goal, but then it was left to settle, with Arsenal scoring their 3rd goal on just 24 minutes, banking a £102 profit.

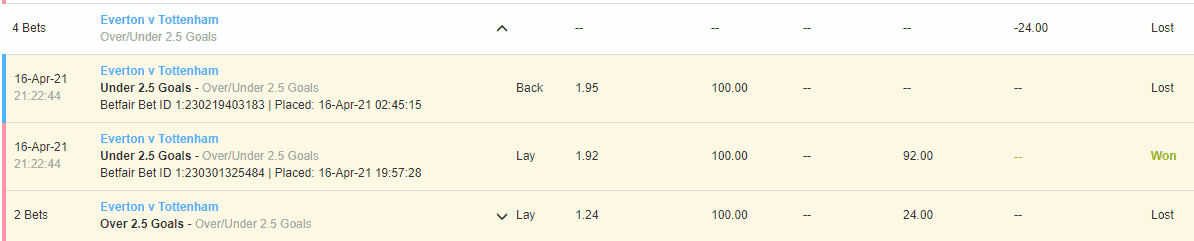

Friday, 16th April, 2021

Everton v Tottenham

Tottenham go in to this match as favourites, currently priced at 2.22, whereas Everton are 3.6, with the draw also 3.6.

Neither teams look appealing in terms of backing outright at the moment. They are also sitting in 7th and 8th in the Premier League table (on 49 and 48 points respectively), and when this scenario occurs, a draw often plays out, since neither side wants to slide further down the table. In fact, all of the analysis elements show that this match will end in a draw.

The two teams recently played out a 5-4 in the FA Cup, but this is a red-herring and won't be repeated in this instance. Instead, it is expected a tight, cagey game will occur with neither team wanting to concede or lose.

Instead of a high-scoring match, it is likely to be 0-0 or 1-1. Already on the exchanges, the most likely result is seen as 1-1 at 7.6, with the second favourite score line seen as 0-1 (9.2). Predictology are also highlighting 1-1 as the most likely score.

Therefore, under 2.5 goals is favoured for this Friday night feature.

Under 2.5 Goals

Backing ‘Under' offers decent value for this match from a trading perspective at 2.06. Therefore, I took a back position on under at 1.95 for £100. However, with Tottenham scoring on 27 mins, I began to reduce risk by laying under at 1.92. In the end, with the score ending 2-2 this resulted in a £24 loss.

Conclusion

Again, it’s been a busy week of matches, covering the Premier League, UEFA Champions League and Europa League competitions.

Overall, the recommendations for this week produced 6.65 points profit, whilst also averaging 2.84 in the trade prices recommended.

Low-Light of the Week

The disgraceful and shameful act of 12 ‘teams’ in Europe looking to join a ‘European Super League’. This included 6 teams from England. Their purpose was to design a closed shop league, where no-one is promoted or relegated from this ‘league’. It is the Americanization of sport, where it no longer can be called sport. It is ‘entertainment’ sandwiched between commercial advertisements and sponsorship endorsements. It’s not surprising that the owners of Manchester United and Liverpool are both American with ownership of other US sport franchises. Until the ownership changes, then they will keep trying to push this hideous concept for the benefit of their pocket and to the detriment of Football in the UK.

It was also evident that fans of the Italian and Spanish teams involved didn’t really do so much. Apathetic. Resigned to the inevitable. Complicit.

High-Light of the Week

To see the huge protests around the UK to the above attempted coup; from government ministers, official football institutions, players, ex-players, managers, clubs. But most of all the fans. Big thanks and respect to all Liverpool and Chelsea fans that went out before their teams’ mid-week fixtures and took a stand. A stand to protest against this attempted robbery of our game. True. British. Spirit. Long may it prevail, because it will need to.

Enjoy the matches this coming week, stay safe, and stay profitable.

Pro Trader

ProTrader started his career and fascination with the financial markets as an Index Analyst at FTSE. He has since consulted for 15 years for some of the top Financial Institutions and Investment Banks in the world, where he specialized in financial instruments, pricing data, trading platforms and risk management solutions. He first started trading sports markets in early 2000, after the introduction and discovery of Betfair. He now trades the financial markets whilst working on entrepreneurial ventures with a focus on sports trading apps and e-commerce. In his spare time, he is writing a series of books soon to be published, enjoys outdoor pursuits with his family, learning Russian and of course, trading football markets.