Opinion: The Ultimate Guide to Betting Portfolios: Part 2 – How to adjust your bank & manage risk / leverage

In part 1, I outlined how to set up a betting portfolio, including information on determining the size of your bankroll, and opening up several online accounts with different bookmakers to boost your chances of getting the best odds. In part 2, I am going to show you how to adjust your overall bank and manage the risk you’re exposed to. Remember, more risk = higher returns, but also a higher chance of going bust.

How Much Should I Bet?

In the world of betting, there are two golden rules. #1 is learning how to recognise the value in a betting market. #2 is learning how to manage your betting bankroll. The two rules don’t work without one another. No betting system on Earth will achieve long-term profitability without consistently finding value.

However, you could excel at rule #1 and lose because you have no clue how to manage your bankroll. Hopefully, you already know that a betting bankroll is an amount you’re willing to risk (or invest) in sports betting. Let’s say you are prepared to risk £3,000 throughout the next year.

I strongly believe that you should have at least 50 units per portfolio asset. Let’s say you have decided to focus on:

- Premier League Football Home Teams to Win.

- Odds-on favourites in National Hunt Hurdle races to win.

- -1 Handicap bets on a selection of amateur football leagues.

- Heavily favoured boxers to win via TKO.

- Match goals in Latvian second division football matches.

You now have five assets. You also don’t have to restrict yourself to 50 units per asset. A 300-unit total portfolio offers a nice round figure of £10 per unit. You could put 50 units into the boxing and Latvian league games, 60 units for the National Hunt races, and 70 units apiece for the Premier League and amateur league games.

Basically, I recommend putting more units into assets where there are likely to be more bets. Let’s face it; there are a lot more Premier League games than boxing matches available to bet on.

As for how you should stake as your portfolio (hopefully) grows, it’s up to you. I’ve read a few guides which suggest you should follow Kelly’s Criterion instead of Flat Stakes betting. This is poor advice because, in order for Kelly to work, you must get the size of your ‘edge’ 100% correct, a virtual impossibility.

Betting the same amount on a 1.6 shot as you do with a 4.0 bet seems like folly, but if you know you have an edge, it will yield a profit in the long-term. Yes, the 1.6 shot has a higher percentage chance of winning, but if the 4.0 bet offers a greater edge, it is the better value bet.

As your bankroll increases, you should stick with a rigid percentage of your bankroll. In our example, you are betting 2% of your bank on the boxing bets. If the asset grows to £600, those £10 bets should become £12.

Managing Risk

Diversification of Assets

If this is the only piece of advice given on managing risk, then it is enough! In financial investment, investors are urged to split their portfolio into diverse markets such as hedge funds, private equities, and emerging markets. They are also advised to split the risk.

The same advice holds with betting portfolios. If you want to add in a riskier proposition with greater reward using the example assets above, you could restrict all match goal bets in Latvian second division games to markets with odds of 3/1 or higher. If you remember from Part 1, I advised you to have low, medium and high-risk assets.

With diversification, your entire bankroll can survive if one of your assets hits the skids, as long as you have a low-risk asset or two which will churn out smaller profits with shorter losing streaks.

Keep Fees Down

This is only applicable if you use a betting tipster service such as Football Advisor. If you purchased the Full FA Portfolio, your ROI would be 2.5% over 10 months from August 2017 to May 2018. This means you would earn £250 for every £10,000 you wagered.

This may not seem like much, but the Return on Capital is 50.9%. If you check out the graph on this page, you’ll see that a cumulative profit of £1,044 in August 2017 became £6,678 in May 2018 (assuming you use £35 stakes), a profit of £5,634 across 10 months.

12 months access costs £750, which equates to £625 across 10 months. In other words, you earn just over £500 a month tax-free profit from £35 stakes after fees! The point I’m making here is that you must check the fees of any tipping service, and compare them to the overall profit according to the stakes you plan to make.

Many services list their profits according to stakes of £100 or more. You’ll often find that their fees are not worth it for average punters who make bets of £10-£40.

Go Off the Beaten Track

This is contrary to financial investment advice which says you should stick to mainstream assets such as companies on the FTSE 100 and S&P 500. It is a little different in sports betting. In football, for example, bookmakers have major leagues analysed inside out.

They still make mistakes now and then, but they are more likely to offer value odds on obscure, amateur leagues. Become an expert on the Estonian fourth division, and there’s no telling where it could take you.

Stick to What You Know, Or Get the Help of Experts

Don’t bet on amateur leagues if you don’t have the knowledge. If you want to get an edge, you need to learn about the quirks of specific leagues in certain countries. For example, I have learned that German Fifth Division (Oberliga) games, especially those featuring the second and third string teams of major clubs, are more likely to have freakish scorelines at the end of the season when certain sides have nothing to play for.

Leveraging

Standard investment advice also includes a warning to avoid leveraging. In the financial markets, leveraging is the process of using borrowed money for short-term investments designed to maximise your returns. For responsible investors, leveraging is an unacceptable risk in a portfolio, irrespective of the possible gains.

It has some uses in the investment world. Let’s say you want to purchase 1,000 shares of a company at £2 a share. Normally, you would need to invest £2,000. If the shares go up 20%, you enjoy a profit of £400. If the shares fall by 20%, you lose £400.

There are leverage providers that allow you to have a margin requirement of just 10%. In other words, you could control £2,000 worth of shares by investing just £200. If the price goes up by 20%, you still earn a profit of £400, and you still lose £400 if it falls by 20%. Therefore, leveraging works if you can afford the losses but don’t have enough ready cash to make the initial investment.

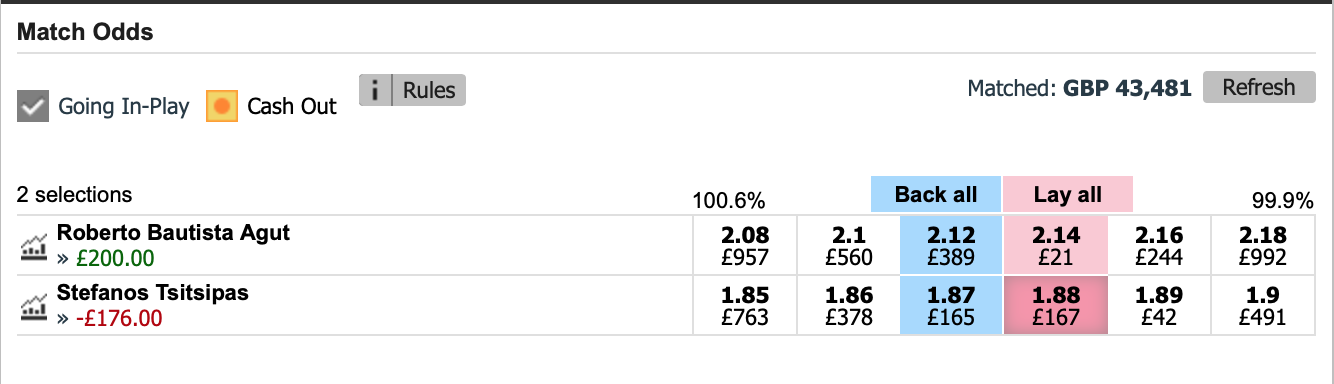

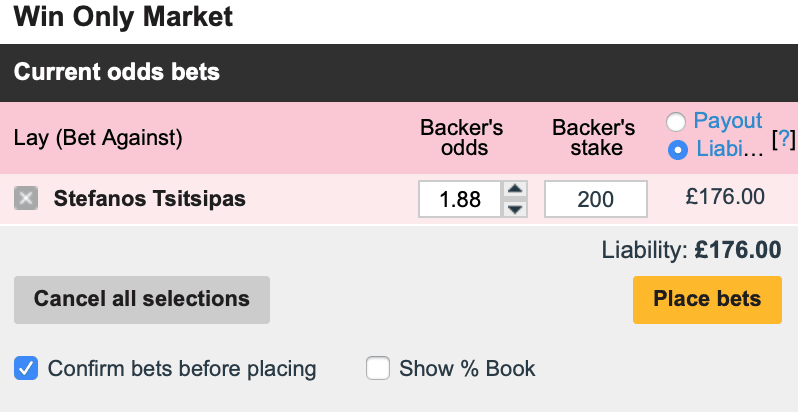

In the world of betting, leverage is best used to describe backing and laying on the Betfair Exchange. It offers you the opportunity to leverage your bank with odds under Evens because you can bet the liability rather than the amount of money in your bank.

In this example, you can lay Stefanos Tsitsipas for £200 at odds of 1.88. As the odds are below 2.00, you are only risking £176 to win £200. Of course, that’s the same as betting £176 on a team to win at odds of 2.25.

Final Thoughts

Don’t waste another moment; make sure you know how much you’re willing to risk before settling on the size of your portfolio. Choose at least five assets and make sure there is at least one low, medium, and high-risk asset. Make sure each asset has a minimum of 50 units and divide your stakes accordingly. If you end up with a per unit bet size that you’re not comfortable with, increase your number of units.

By diversifying your portfolio, you reduce the risk of going broke. If you choose a betting service, please make sure their fees are worth the profit, and that they can provide evidence for their ROI and Return on Capital (ROC) claims. Although there is much to be said for sticking to the Big Five European leagues, I believe there is tremendous value in amateur football markets. Make sure you do your research before committing money, however.

Leveraging mainly applies to Betfair Exchange and is different to leveraging in financial markets, although there are betting portfolio companies willing to offer you a lower margin. I would personally avoid leveraging at all costs because it only takes a couple of mistakes to utterly ruin your finances.

In part 3, I will look at the pros and cons of betting portfolios so stay tuned!

Free Report – Successful Betting Portfolio:

A step by step guide to building a successful and profitable betting portfolio. Download for free here

Free Report – Secret Staking Plan Success:

Access the Secret Staking Plan that has delivered over 6,000% compound growth this year

Weekly Best Bets:

It is designed to be a really easy and enjoyable service to follow along with just a couple of emails a week and a handful of well researched and supported bets recommended to you each week. If this sounds like something you'd enjoy why not join us for the full European season for just £9.95 a month or £77 £37 for the whole season.

Jon is the Founder and Chief Tipster at Football Advisor and Predictoloy. He started life as data analyst in the digital marketing field before find his true calling in the world of Football and Horse Racing Betting.

Jon has been sharing his professional expertise since 2009 and specialises in using objective data analysis and subjective experience of betting built up over more than a decade of professional betting.

In 2014, Jon also launched (and continues to run) the trusted Football Advisor service service which provides a variety of football and horse racing betting models and portfolios. A few years later, Jon launched the Predictology platform which is the worlds first betting system builder and analyser covering a wealth of football betting related statistics covering more than 200,000 matches.

Jon has also lent his knowledge and expertise to several of the trusted Premium Services offered by the respected Secret Betting Club, including Football Lay Profits. Racing Bet Profits and, most recently, Racing Lay Profits.