Don’t Get Pissed And Trade – Trading Analysis Part II

One of the biggest things about trading is that we need to have a clear head. I don't just mean, don't be pissed when you trade, but rather, clearing the mind before sitting down and committing to a day's trading.

I generally take 5 minutes to take some deep breaths, picture a waterfall and imagine any of “life's issues” getting washed away with the falling water. Philosophical stuff, hey!

If you're worried about the next bill, the wife's increasingly expensive Amazon shopping (that generally, get sent back, after an afternoon of twirling in front of the mirror!), what the weathers going to be like for the BBQ you've got planned this weekend… STOP

Clear your mind and forget about these things and then really focus on what it is you're doing before even logging into your exchange account.

Take a note of your starting balance, what amount you're willing to risk on each trade and more importantly what you're going to be trading on.

Last week I looked at how I planned my day and knew exactly what it is I would be trading on. Thirty minutes before I'm ready to trade, I get everything set up and then sit quietly with old “waterfall” technique and then BOOM, I get stuck in and there's nothing else going on in the world apart from my trading.

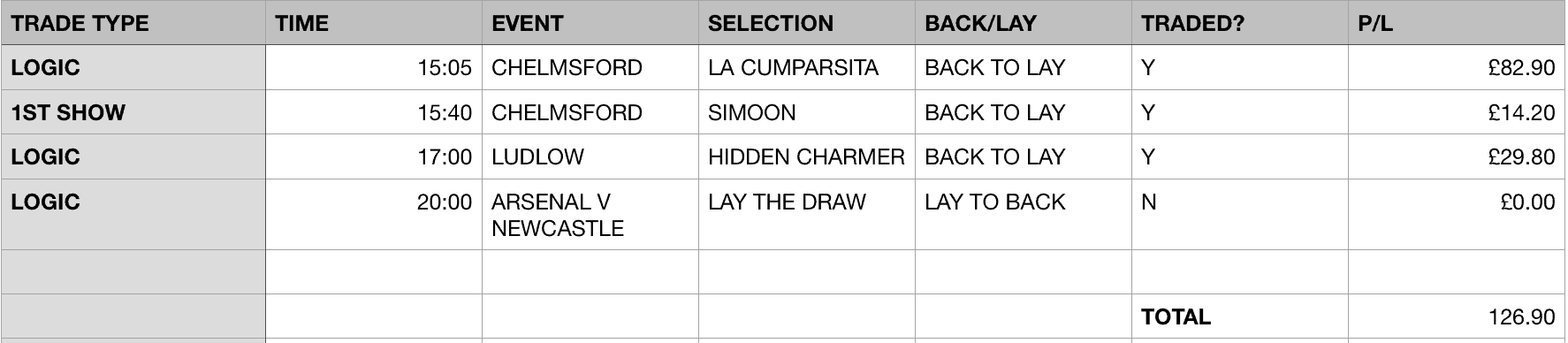

This is what last Monday looked like –

Whatever method of trading I'm using, I generally set this out into an excel sheet. Like the one, below –

I wanted to explain what each type of trade was and how I came about them.

The Logic trade is where I've already decided to trade the event first thing in the morning.

The 1st Show trade is where I decided to trade as just before the event is about to start.

The first trade, above on La Cumparsita was based on a recent trainer switch with the horse and the trainer's knowledge of placing horses. He'd come 3rd over a mile on his first race with the trainer and then was dropped back a furlong to 7. I knew he was well placed and was overpriced at around 3/1 in the morning. I then layed him off at 2/1 before the off.

That reasoning and analysis were based on logic.

The 1st Show trade was a result of looking at the markets at around 10 minutes before the off and analysing something called the weight of money or WOM as we'll now call it.

This is where we can successfully predict which way the horse's price is going to change in the lead up to the race. We'll cover more of that in a later piece.

Anyway, this was all done with a clear head and then the getting pissed bit came AFTER the trading 😉

I'll be back next week with a more in-depth look at WOM and how we can use it to pick out quick and easy trades.