The Proof Is In The Pudding – A Beginners Trading Guide Part III

Keeping Records

This one is another no-brainer really and if you have been doing any form of betting or trading for any length of time this should be second nature already.

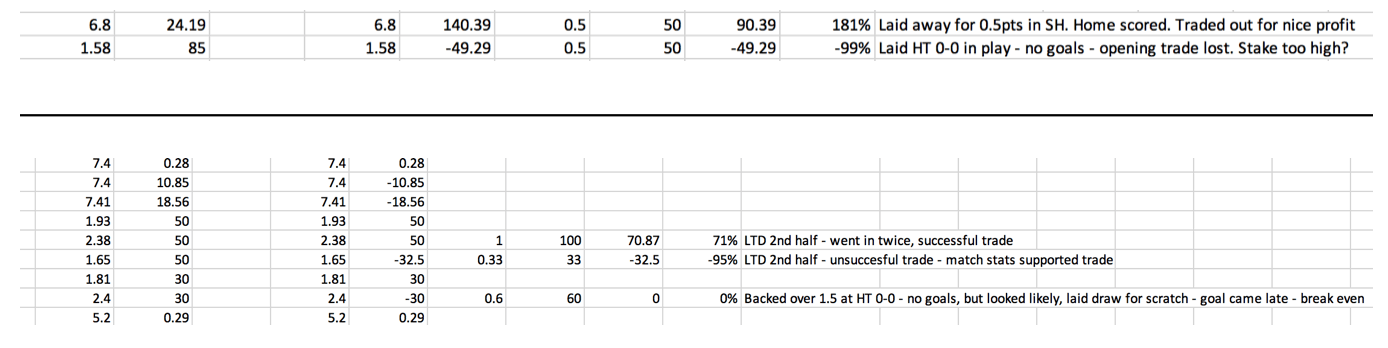

But I stress the point here again as I’ve found it really useful with my trading – what I do is record all my entry and exits and P&L as you’d expect – but the most useful part of this is the notes entry I include in each trade.

In a few short words, I write why I entered the trade, what I was looking to happen and then the outcome. Plus any learnings or mistakes that I can benefit from later.

It’s really invaluable to do this no matter what your experience level is.

Find What Works For You

I’ve spent, probably six months or more, trying out many, many different trading approaches. Some are widely available, for free on the internet from great resources such as Caan Berry, others I have developed myself based on my own knowledge and access to data, plus using high quality paid services, such as this one which is easily one of the best – Predictology

I’ve whittled all of these down to somewhere in the region of 5-10 core trading models that I will use on a regular basis (some will daily / weekly, others I will do when opportunities present themselves, but occur less frequently).

None (or at least very few) of the trading strategies that I have discarded have been bad or don’t work. It is simply a process of elimination to find the ones that suit me best today (and your list may be different) – they suit the time I have available and the risk/reward ration that I am comfortable with right now.

In time, I fully expect to add more or revisit some of those other strategies but the ones I have chosen are best for me and best for me to sharpen my teeth on.

I recommend that you do the same – test as many strategies as you can (too low stakes of course) to find what is right and works best for you. It is great for your learning and building experience, and understanding the markets.

I hope you have enjoyed our opening series around my own personal experience and journey into trading, from the perspective of an experienced bettor.

In the coming weeks, I will continue to share my experiences, successful and (unsuccessful) trades and more insights, observations and learnings.

I’m starting to see some real and tangible success so far and I’m very keen and excited to build on this – I hope that this will also help others, like you, become a successful trader.

Recent Trading Examples

Currently, I am working off two main categories of trades.

- Automated

These are trades that are effectively set and forget. Using my existing models, I am able to identify games that fit the target criteria. I then place a bet pre-match or at a certain point in a game (or the bot does) and then look to trade out once the prescribed action or event takes place.

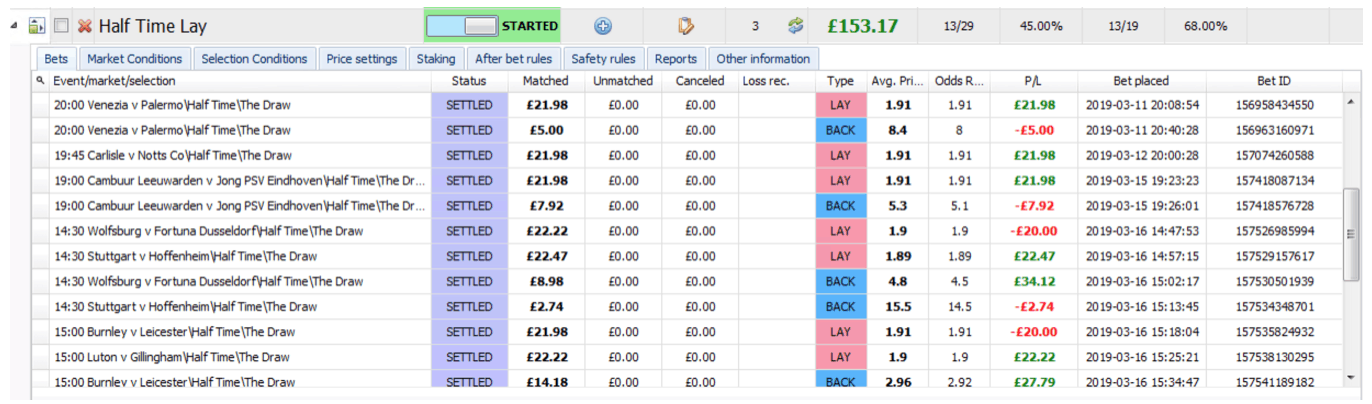

HT Lay

Here I am carefully selecting games with a high likelihood of there being a goal in the first half. If the match ticks the boxes and the price falls within my range, I will lay the draw and trade out for a profit once I see a goal.

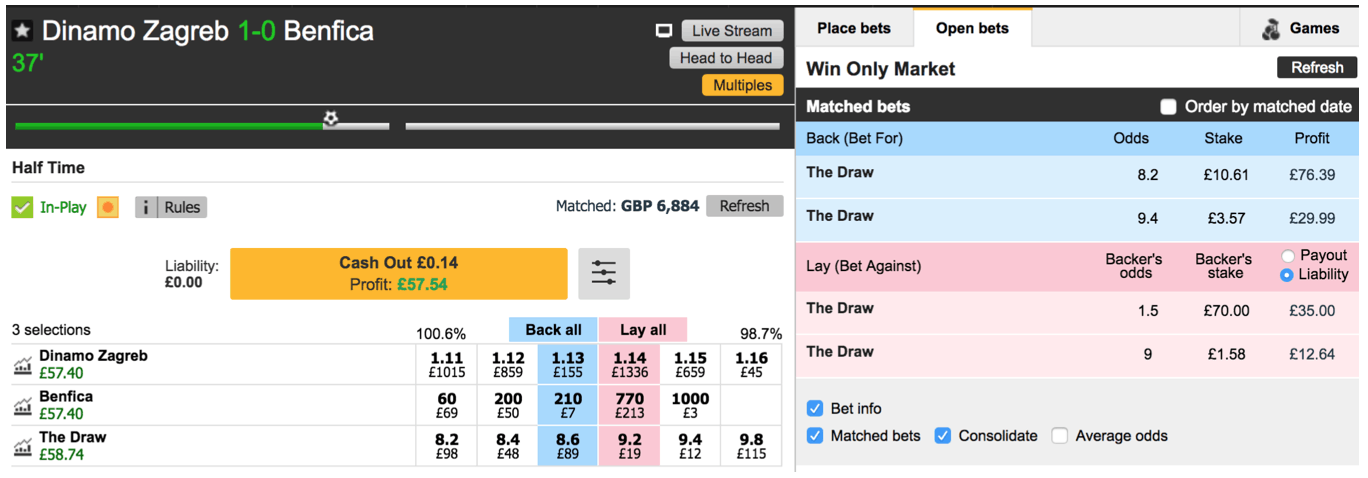

Here is an example of this trade in action. It was 0-0 mid-way through the first half but the stat’s were indicating a goal soon was likely.

I laid the half-time draw at 1.50 and soon after Zagreb scored and I was able to lock in a 50% profit across the board.

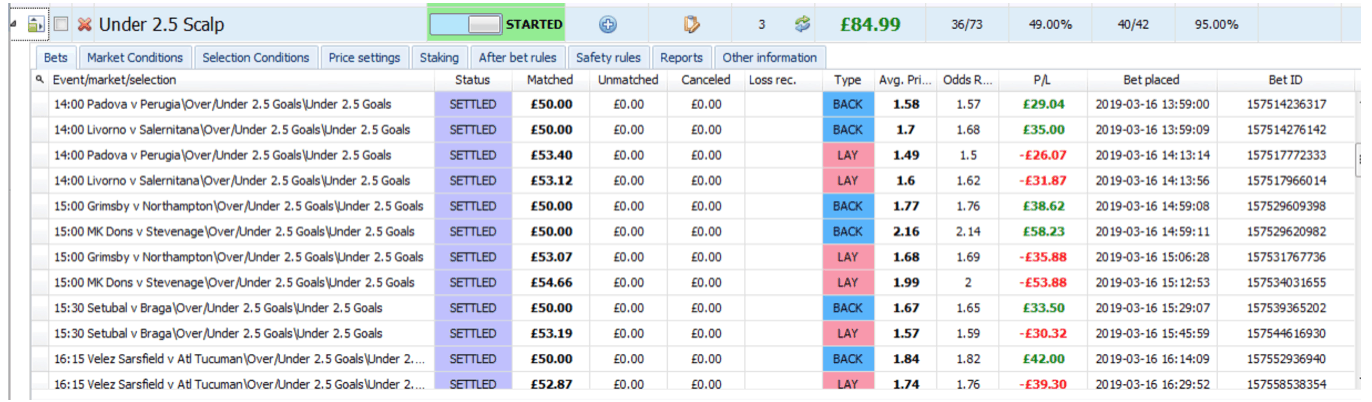

Under 2.5 goals

Again through a carefully selected and a curated list of selections, I am identifying games with a low goal potential.

Then using price-decay to identify an exit point to lock in a profit.

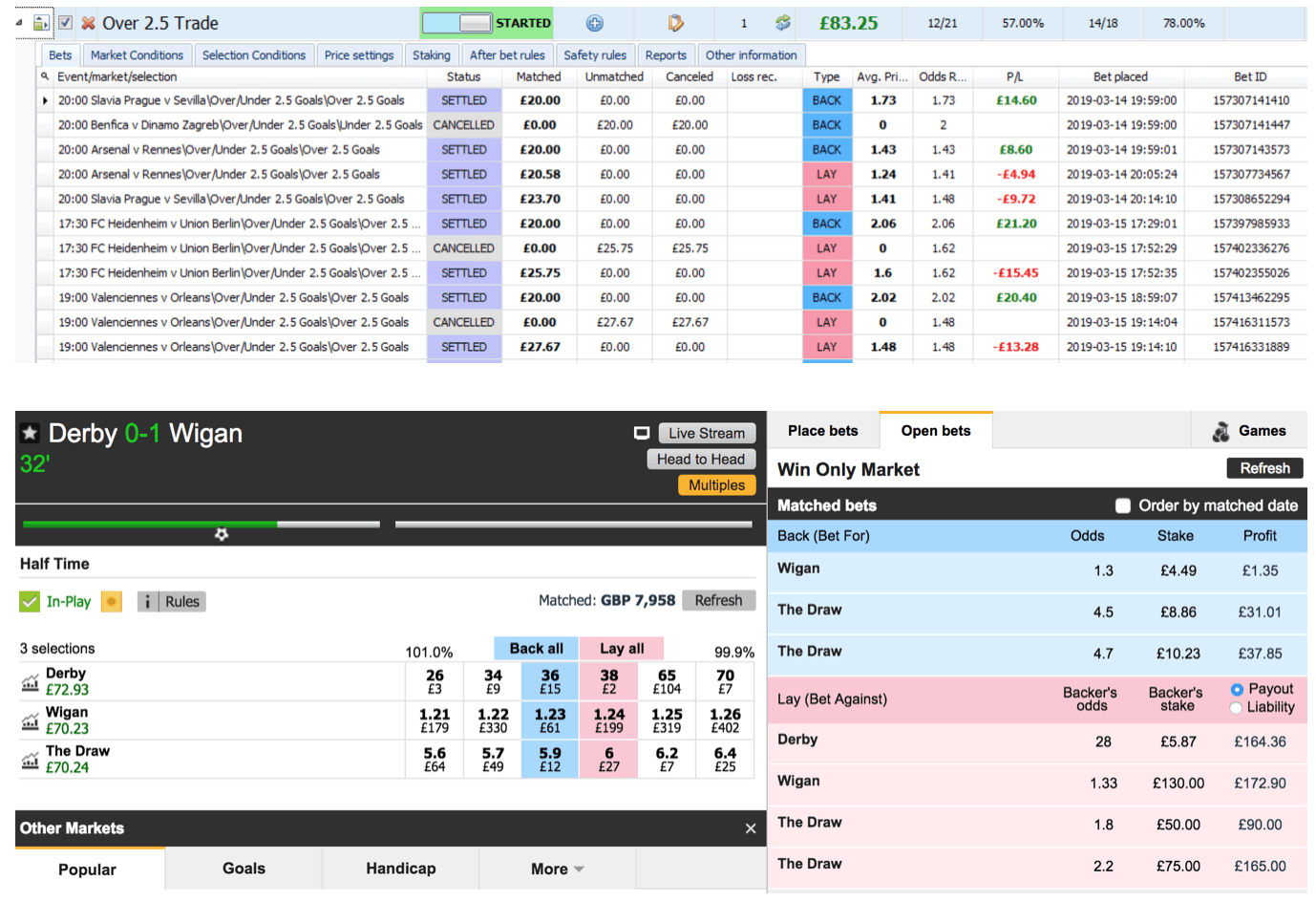

Over 2.5 goals

Very similar to the above, but targeting over 2.5 goal market and locking in a profit once a goal is scored.

There is the potential to make the first trade a scratch and keep the green on the goals. It’s something I’m monitoring currently.

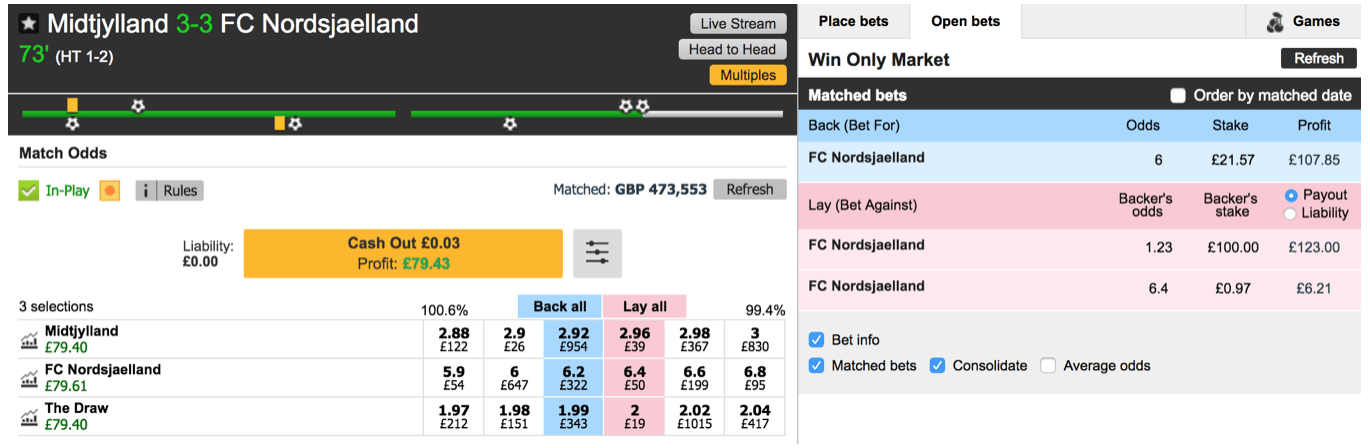

This was of an instinctual trade.

I already had a vested interest in this game from one of my betting models so I was watching it quite closely. It was safe to say the match wasn’t going as intended, at least from a scoring perspective.

Midtjylland has gone down 0-1, 1-2, and then 1-3 and I wanted at least a draw from the home side.

Despite the scoreline, both Midtjylland’s home record and the in-play stats indicated that this game was far from over.

I made up my mind and entered the trade with a £100 lay at 1.23 (risking only £23.00) by laying the away side.

Two goals in quick succession brought up the 3-3 and allowed me to trade out for a 300% profit.

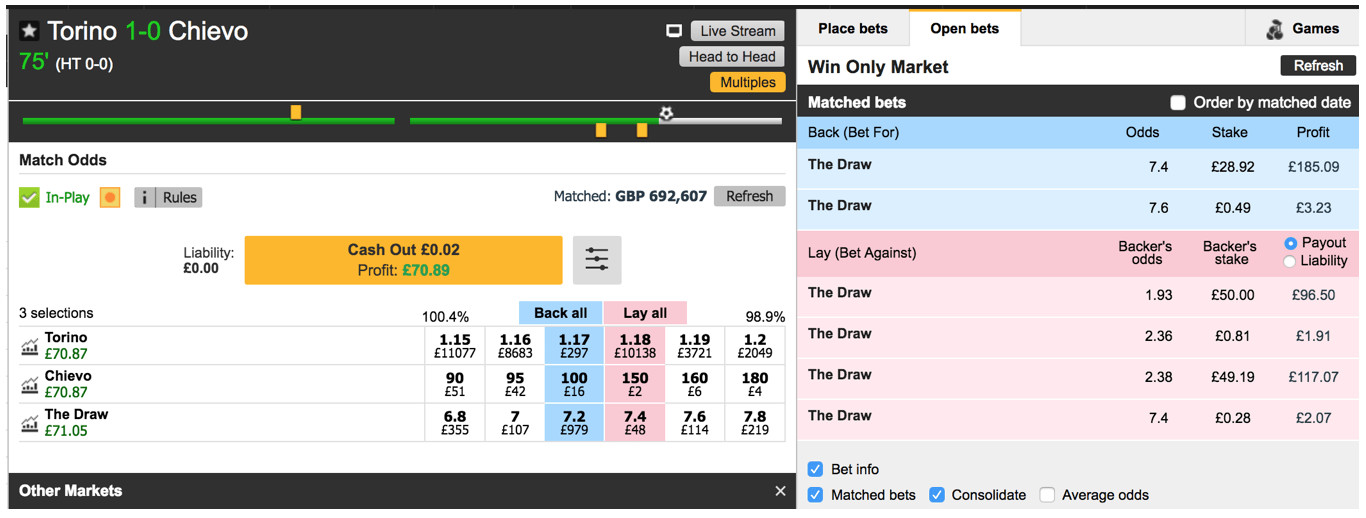

This trade was based on both the pre-match stats (Torino see a lot of late goals) and the fact that they had been on top for most of the match. A Torino win looked likely, even at this late stage of the game.

I entered the game around the 70-minute mark by laying the draw which was odds on by now.

Low and behold, a few moments later Torino scored and I was able to lock in more than a 100% return.

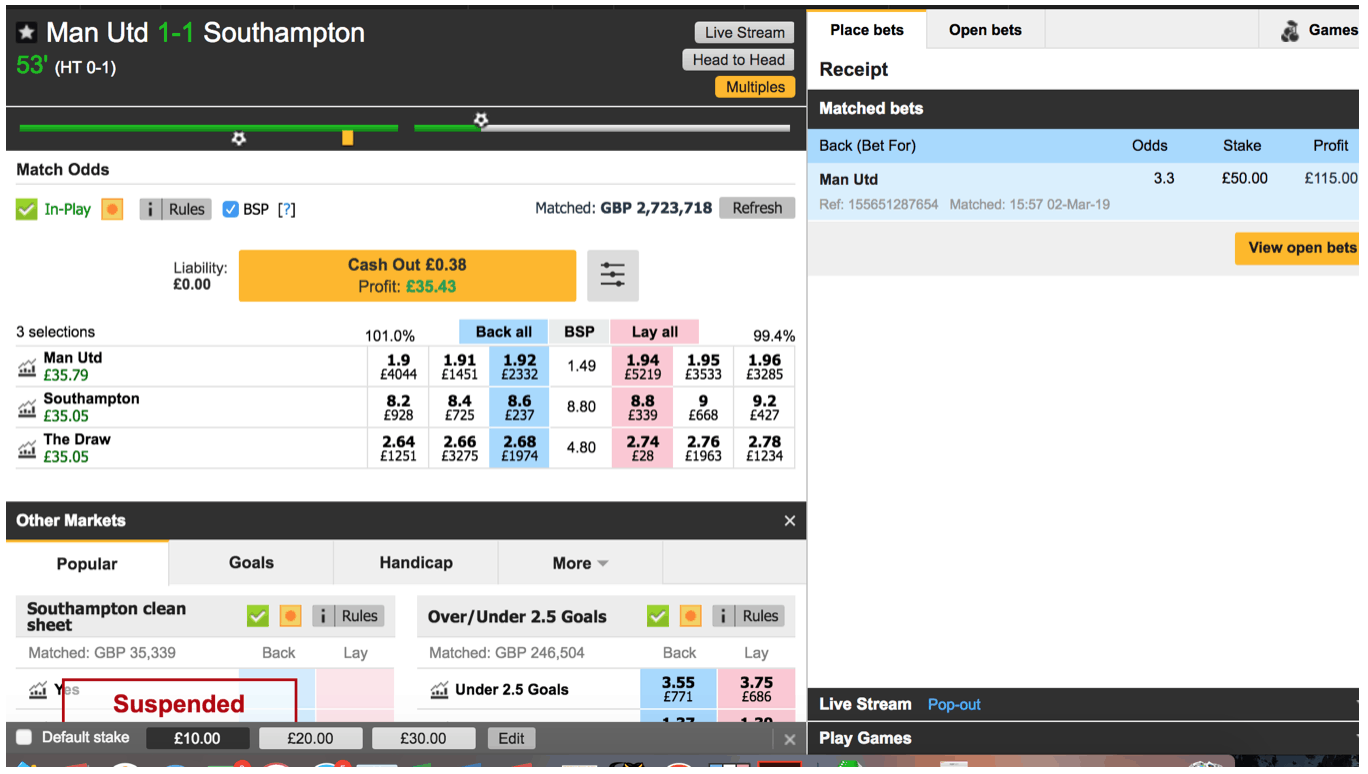

The above was another instinctual trade. Southampton found themselves 1-0 up at half time and were playing well. But it looked like an open game and that there would be goals in the second half (finished 3-2).

United were still in their hot run at this point and I felt that the odds on the United win at half time were too high and I entered the trade just before the second half.

Man Utd soon found an equaliser and I could have kept this open as United looked on top at this point, but my plan had always been to get out of the trade as soon as possible and that’s what I did (it’s always best to decide your exit point before entering and stick to it).

And, of course, the Losers…

No matter who well you prepare, no matter how the stats look – it is inevitable that you will find losing trades along the way (this is why bank management, staking, discipline and notes are so important).

One such example was the first leg of the Europa League tie between E.Frankfurt and Inter Milan.

I started with a half-time lay because the game looked open and the stats indicated a goal was coming.

Straight after entering the trade, Inter got a penalty and….missed

My half time lay was a loser but I still very confident that a goal was likely. I doubled down and laid the draw at half time but despite the match continuing to appear end to end and the positive scoring records of both teams, the match ended 0-0 and I lost both bets.

That said, I don’t regret this bet at all. I would still place the same bet today based on the information available – I don’t mind losing bets or trades when I believe I was right to enter it in the first place.

It’s the ones you make when you look back and can see it was a mistake from the beginning which are the ones you need to learn from and try to eradicate.

Such as this one…

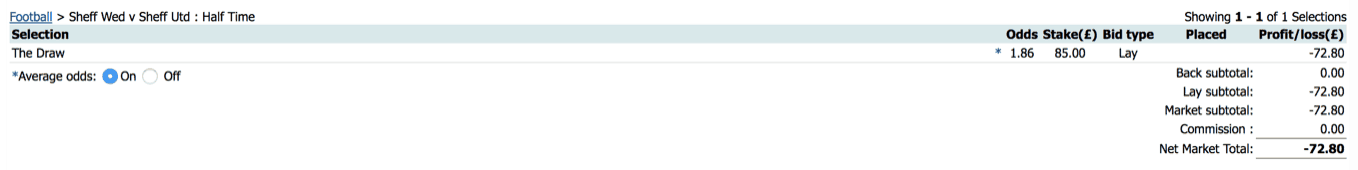

I started with a half time lay. What’s wrong with this picture?

- My stake was too high based on my normal half time lay prices

- The in-play match stats did not support entering the lay

- The pre-match stats did not support entering the lay

- I entered the lay with the thought of recouping some earlier, minor losses

Wrong, wrong, wrong – told you mindset was not in the right place on this given evening

Obviously, we reached half-time and the game was nil-nil.

What I should have done here is bite the bullet, accept the losses, turn off the computer and go and watch Netflix.

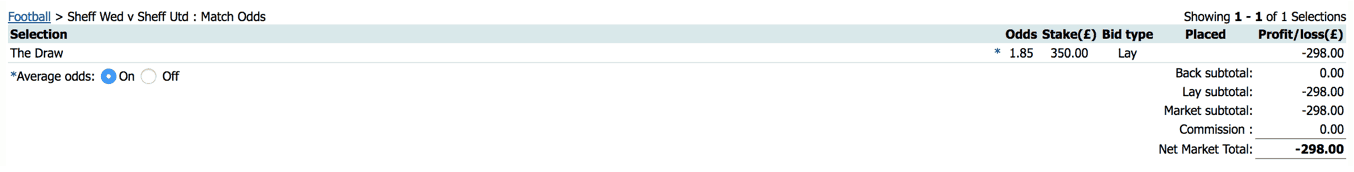

But what I did instead was persist in the worst possible way.

I increased my stake significantly and way out of line with my normal staking.

There was simply no reason to enter this trade and there was nothing to support it.

What was I doing? I was gambling (In it’s worst form) on 1 goal being scored. I don’t know maybe I wanted to be a bit reckless, whatever my mindset was at that time it was wrong on every level.

I, more than most people, should know better. But I share this both as a humbling experience, to use the embarrassment to remind me never to fall into this trap again and, probably most importantly, to show you that we are ALL human and we can ALL still make mistakes – even when we know better.

But don’t let your mistakes define you or allow you to give – learn from them, use them and do better the next day.

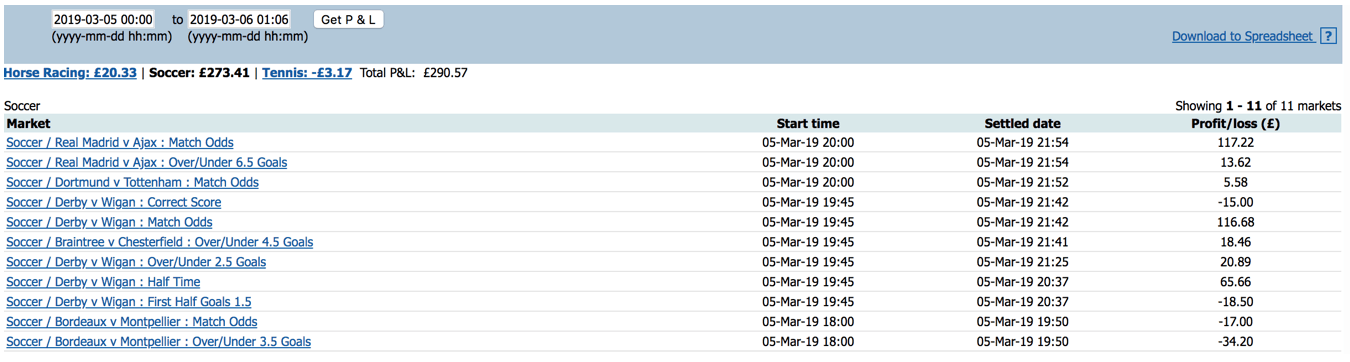

Fortunately, I was able to come back the next day fresh and in a much better mindset and recover the loses from the day before

But if I had heeded my own advice, taking the 4th off as I was not in the right mindset, and just returned fresh on the 5th, we’d be talking about £300 profit – not break-even.

So, please, please, if you not in the right mindset to bet or trade – don’t

It’s really that simple. Let me know what you think in the comments, below 🙂

Jon is the Founder and Chief Tipster at Football Advisor and Predictoloy. He started life as data analyst in the digital marketing field before find his true calling in the world of Football and Horse Racing Betting.

Jon has been sharing his professional expertise since 2009 and specialises in using objective data analysis and subjective experience of betting built up over more than a decade of professional betting.

In 2014, Jon also launched (and continues to run) the trusted Football Advisor service service which provides a variety of football and horse racing betting models and portfolios. A few years later, Jon launched the Predictology platform which is the worlds first betting system builder and analyser covering a wealth of football betting related statistics covering more than 200,000 matches.

Jon has also lent his knowledge and expertise to several of the trusted Premium Services offered by the respected Secret Betting Club, including Football Lay Profits. Racing Bet Profits and, most recently, Racing Lay Profits.