Weight Of Money – It’s All On The Other Side!

Over the last couple of weeks, I have highlighted the importance of planning the day ahead, when it comes to trading and also making sure we have the right mindset.

Planning the day ahead is vital so that we can make sure we're available at the right times. There's no point in analysing a football game at lunchtime, knowing that we're going to be working/or our partner is going to be demanding we fix that wonky shelf!

You can read about planning your day's trading here

Once we've planned our day, we then need to make sure that we've cleared our head and have everything set up to execute our trades to the optimum. Again, it's no good sitting down to trade a selection and then have that “niggle” at the back of your mind, that the shelf downstairs is all to cock!

You can read about clearing your mind and preparing for a trade here

In today's article, we're going to get a little more technical. Once we've understood the above advice, have planned our day and have a clear head, we now need to understand some of the basic principles around how the markets work.

We will cover some actual techniques in next week's article but for today, we need to grasp how the exchanges actually work, in order for these techniques to make sense.

All markets are driven by something called WOM. This stands for “Weight Of Money” and is the very reason odds fluctuate.

In simple terms, the more money there is for an outcome, the shorter the price will become and vice versa.

I'm not going to go into the technicalities of how over rounds, pricing up and odds work with the bookies, as we're going to be ONLY using the exchanges for our trading. However, we can start with the bookies as a benchmark to first look at a particular market.

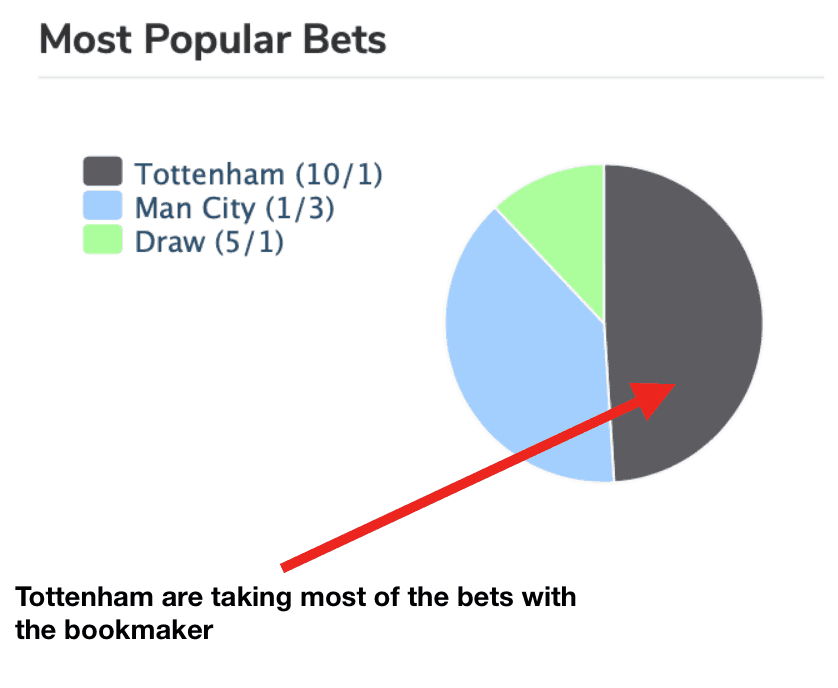

Let's look at a game and see what is happening with the WOM with the bookies –

49% of all bets for a game between Tottenham and Man City are being placed on Tottenham. This would suggest that the price will shorten from the time of looking at this information.

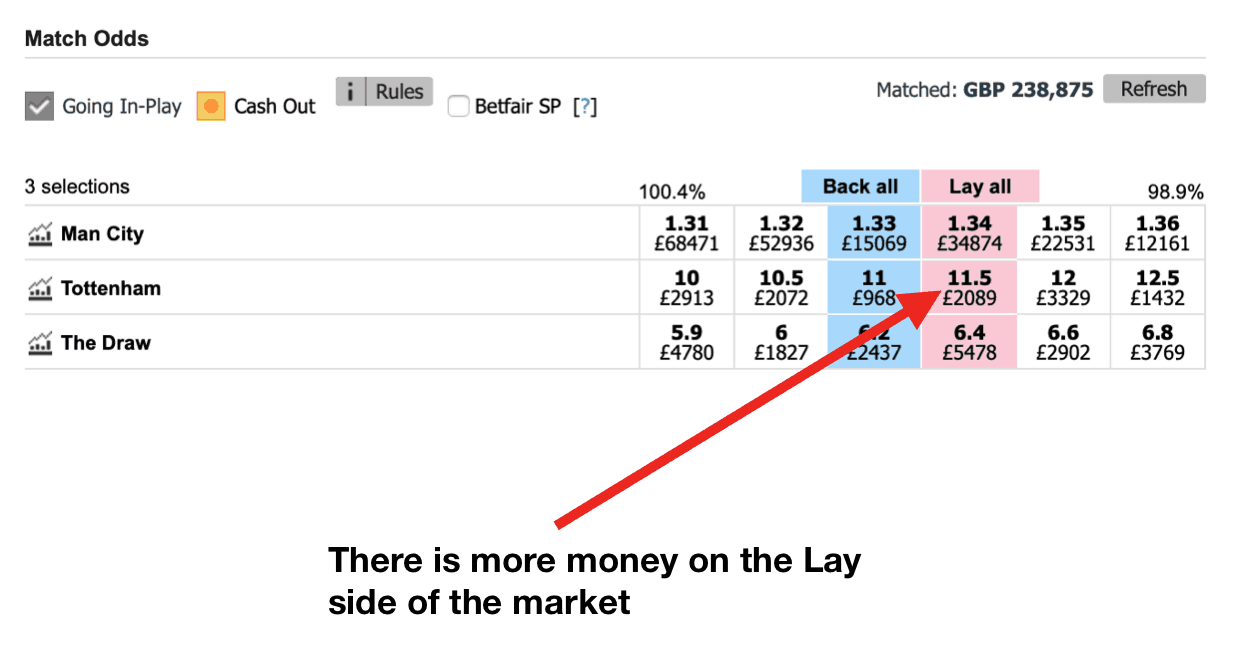

To further understand this, we need to now look at the exchange market.

When we back something on the exchange, we're placing our stake into a queue, which will appear on the Lay side of the market. This means that anyone wanting to lay Tottenham can match our bet.

Taking a look at the exchange market we can see that there is more money on the lay side of the market than there is on the back side. This confirms the information that we saw in the pie chart.

There is £5,953 waiting to be matched on the back side (the blue boxes) and £6,850 waiting to be matched on the lay side (the pink boxes). The £6,850 on the lay side is people wanting to back Tottenham. As this is a larger number, this simply means that there are more people wanting to back Tottenham than there are people wanting to lay them.

As a result, we should expect Tottenham to shorten up as these prices get matched.

It's not always as simple as that but I hope that this illustrates how WOM works and how understanding it can give us a basic understanding of which way the market will move.

Next week, we will look at ALL of the outcomes of a game, how we can use WOM to determine our starting position when trading and how the percentages tie in with this.